Sure, here is what you need to know about the National Pension System (NPS) and the Employee Pension Scheme (EPS):

- National Pension System (NPS) is a defined contribution pension scheme that was launched in 2004. It is a voluntary scheme open to all citizens of India, including salaried employees, self-employed individuals, and pensioners. Under the NPS, individuals contribute a certain amount of money every month, and the money is invested in a combination of equity and debt instruments. The returns on the investment determine the amount of pension that the individual will receive after retirement.

- Employee Pension Scheme (EPS) is a defined benefit pension scheme that was introduced in 1995. It is a mandatory scheme for all employees who are members of the Employees' Provident Fund (EPF). Under the EPS, the employer contributes 8.33% of the employee's salary to the scheme, and the employee does not have to contribute anything. The pension amount is fixed and is calculated based on the employee's salary and years of service.

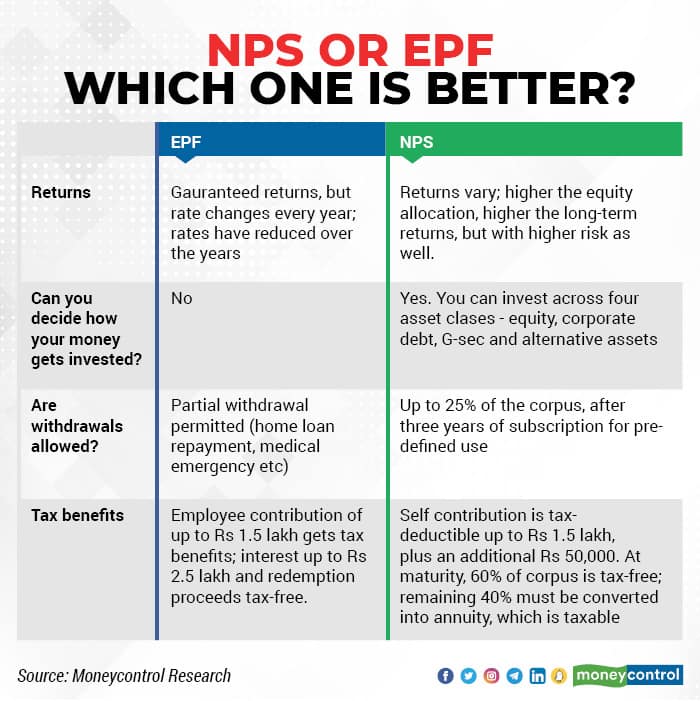

Here is a table that summarizes the key differences between the NPS and the EPS:

Feature | NPS | EPS |

|---|---|---|

| Type of scheme | Defined contribution | Defined benefit |

| Eligibility | Voluntary | Mandatory for EPF members |

| Contribution | Individual | Employer and employee |

| Investment options | Equity, debt, and hybrid funds | Government securities |

| Pension amount | Determined by the returns on investment | Fixed and based on salary and years of service |

The NPS is a more flexible scheme than the EPS, as individuals have more control over the investment of their money. However, the EPS offers a guaranteed pension amount, which may be appealing to some people.

The best scheme for you will depend on your individual circumstances and preferences. If you are looking for a flexible scheme with the potential for higher returns, then the NPS may be a good option for you. If you are looking for a guaranteed pension amount, then the EPS may be a better choice.

Here are some additional things to consider when choosing between the NPS and the EPS:

- Your age: The NPS is a longer-term investment, so it is a better option if you are young and have a long time to retirement. The EPS is a shorter-term investment, so it is a better option if you are nearing retirement.

- Your risk appetite: The NPS offers a wider range of investment options, which means that you can choose an investment portfolio that suits your risk appetite. The EPS only invests in government securities, which are considered to be a low-risk investment.

- Your financial goals: If you have specific financial goals for your retirement, such as buying a house or funding your child's education, then the NPS may be a better option as it gives you more flexibility to choose the investment options that will help you achieve your goals.

I hope this helps!

No comments:

Post a Comment